If it is a Government agency, they may ask for your name, your job title, and your unique id number. If it is your own personal id, you may be able to do a few things with it. Failure to do so could result in having your coverage terminated and potential financial challenges. If you are not sure if you are working in Wisconsin, you can check the state's website to see if you have access to an id card. And if you're ever hit with a sudden bill, or if your tax preparer has forgotten your card number, just show them your Quick Card number and they'll be able to help you out! Hopefully, this article has been helpful - if not, don't hesitate to give our online tax planning service a try! We'll be happy to help you with all of your tax planning needs, starting with your Quick Card number. The North American Id Card is a valuable piece of identification and should be used in conjunction with other forms of government identification to ensure that the holder is lawfully registered and has access to all of the benefits that the card authorizes.

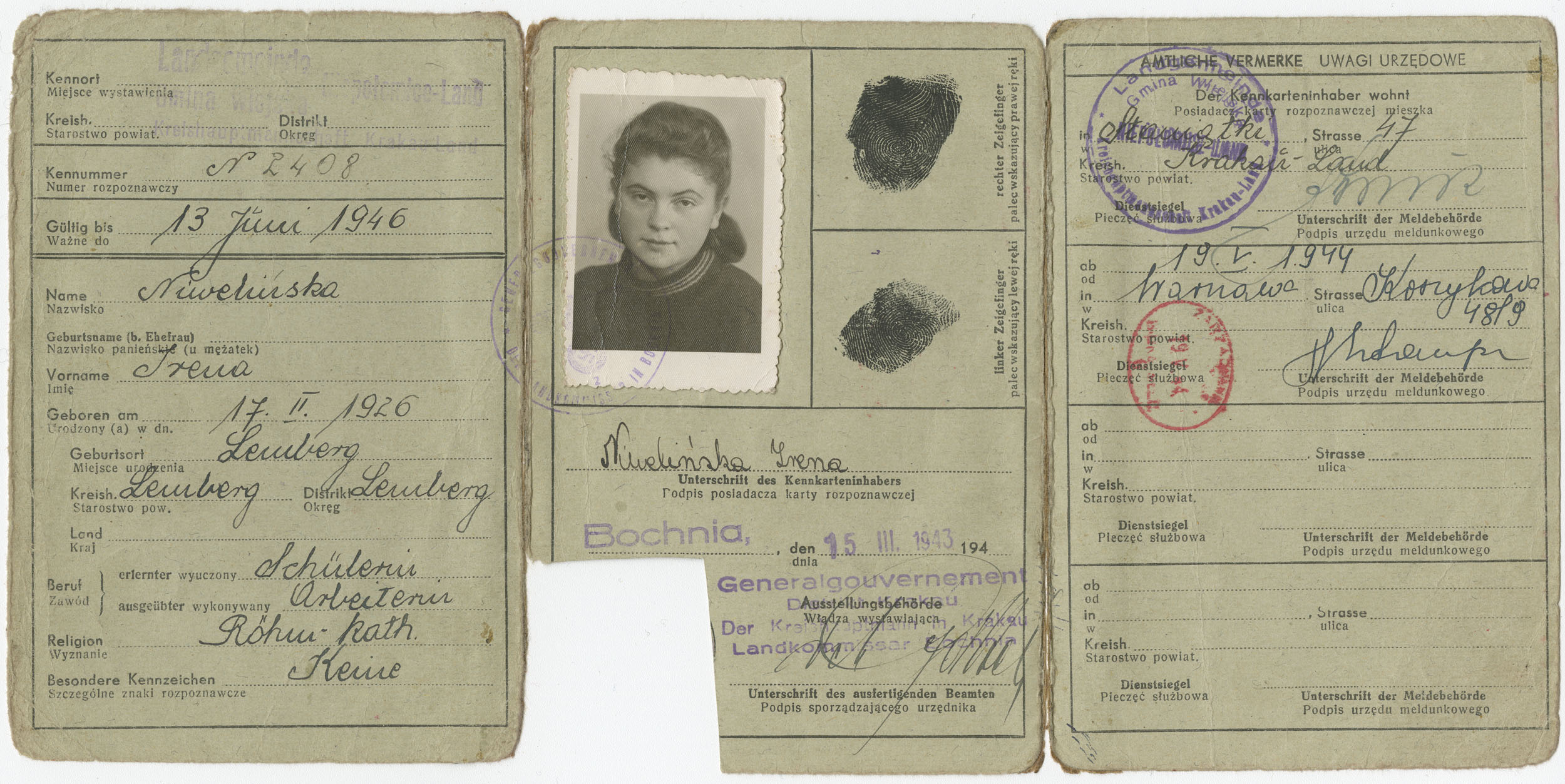

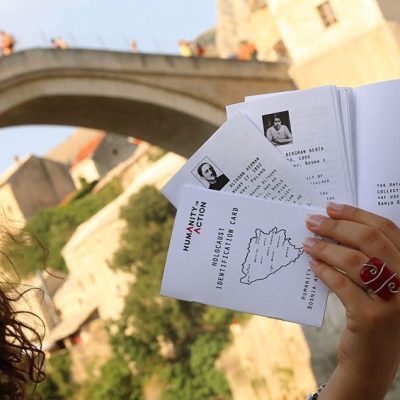

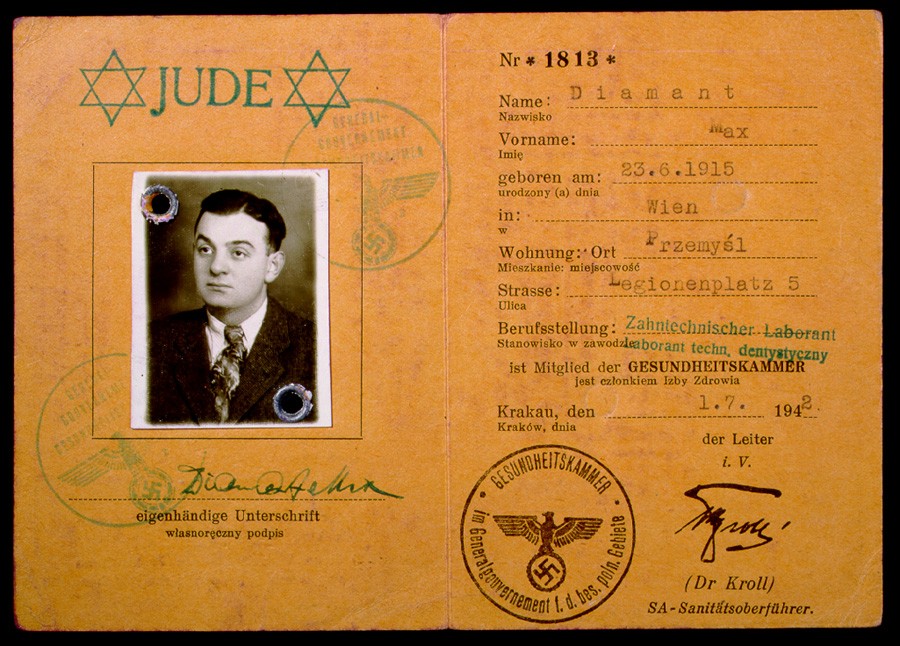

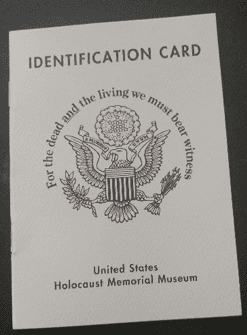

Ushmm Id Cards

Ushmm Id Cards